Online course

Learn to master personal finances with our course

Achieve financial success through our finance program. Acquire the knowledge to manage your finances effectively and reach your objectives.

4.8/5

Trusted by 5,300+ customers

4.8/5

Trusted by 5,300+ customers

4.8/5

Trusted by 5,300+ customers

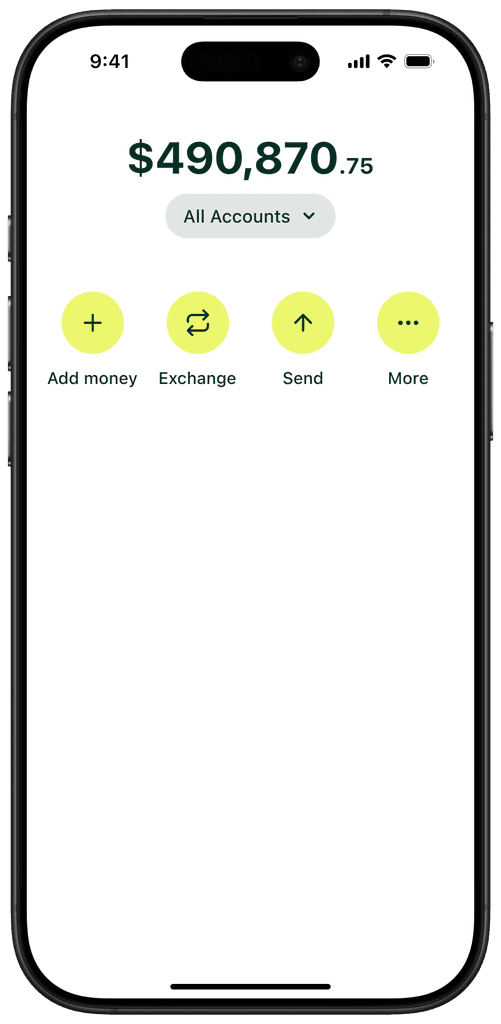

Total portfolio value

$ 42,560.00

Exclusive tools & resources. Get access to premium spreadsheets, templates, and guides designed to help you manage your finances efficiently.

Exclusive tools & resources. Get access to premium spreadsheets, templates, and guides designed to help you manage your finances efficiently.

Exclusive tools & resources. Get access to premium spreadsheets, templates, and guides designed to help you manage your finances efficiently.

Lifetime Access. Enroll once and get unlimited access to all course updates and content for life, anytime, anywhere.

Lifetime Access. Enroll once and get unlimited access to all course updates and content for life, anytime, anywhere.

Lifetime Access. Enroll once and get unlimited access to all course updates and content for life, anytime, anywhere.

Private Community. Join a supportive group of like-minded individuals to share insights, ask questions, and grow together.

Private Community. Join a supportive group of like-minded individuals to share insights, ask questions, and grow together.

Private Community. Join a supportive group of like-minded individuals to share insights, ask questions, and grow together.

how it can be useful for you

Transform your financial future

Master your money management skills

Learn to budget, save, and invest wisely.

Master your money management skills

Learn to budget, save, and invest wisely.

Master your money management skills

Learn to budget, save, and invest wisely.

Achieve financial freedom

Transform your financial future with expert guidance.

Achieve financial freedom

Transform your financial future with expert guidance.

Achieve financial freedom

Transform your financial future with expert guidance.

Invest in your financial education

Take the first step towards financial literacy.

Invest in your financial education

Take the first step towards financial literacy.

Invest in your financial education

Take the first step towards financial literacy.

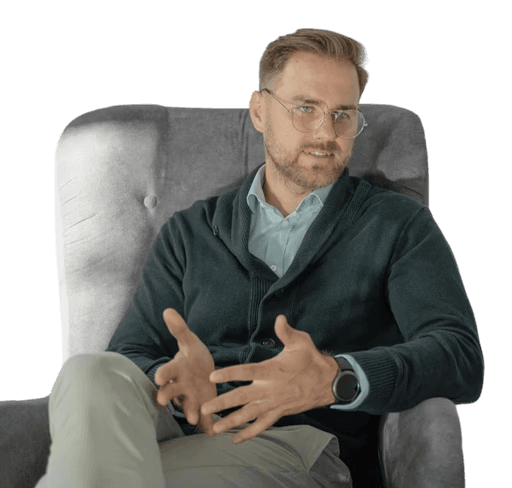

Our idea

About this course

This comprehensive course is specifically designed to equip you with the essential personal finance skills necessary for navigating today's complex financial landscape.

You will have the opportunity to unlock the secrets to achieving lasting financial freedom and stability. Gain insights into budgeting, saving, investing, and managing debt effectively, all of which will empower you to make informed financial decisions that can positively impact your future. Take control of your financial destiny!

Josh Davidson

Financial coach, author of this course

Our idea

About this course

This comprehensive course is specifically designed to equip you with the essential personal finance skills necessary for navigating today's complex financial landscape.

You will have the opportunity to unlock the secrets to achieving lasting financial freedom and stability. Gain insights into budgeting, saving, investing, and managing debt effectively, all of which will empower you to make informed financial decisions that can positively impact your future. Take control of your financial destiny!

Josh Davidson

Financial coach, author of this course

For whom

Who is this course for?

For Individuals

Empower Your Financial Knowledge

Designed to help individuals take control of their personal finances and make informed financial decisions.

For Individuals

Empower Your Financial Knowledge

Designed to help individuals take control of their personal finances and make informed financial decisions.

For Individuals

Empower Your Financial Knowledge

Designed to help individuals take control of their personal finances and make informed financial decisions.

For Families

Secure Your Family’s Financial Future

Families will benefit from strategies that promote saving, budgeting, and investing for long-term security.

For Families

Secure Your Family’s Financial Future

Families will benefit from strategies that promote saving, budgeting, and investing for long-term security.

For Families

Secure Your Family’s Financial Future

Families will benefit from strategies that promote saving, budgeting, and investing for long-term security.

For Businesses

Maximize Your Business Potential

This course equips business owners with essential financial skills to enhance profitability and growth.

For Businesses

Maximize Your Business Potential

This course equips business owners with essential financial skills to enhance profitability and growth.

For Businesses

Maximize Your Business Potential

This course equips business owners with essential financial skills to enhance profitability and growth.

features

Unlock your financial potential

ASPC

AeroSpace Solutions

GNMD

Genome Dynamics

QNTX

QuantumTech

PHDC

Photon Dynamics Corp

ECTE

EcoTech

CYSG

CyberSec Global

FFDX

Future Foods

NMTL

NanoMaterials

GALX

Galactic Innovations

SGSY

SmartGrid Systems

RTBX

RoboTech Industries

IENC

Infinite Energy

UDG

Urban Development Group

AQRC

Aquatic Resources Corp

VRTX

Virtual Reality Ventures

INTA

Intelligent Automation

GHN

Global Health Networks

DSPH

DataSphere Analytics

SOLI

Solar Innovations

CATX

Clean Air Technologies

NTSO

NeuroTech Solutions

BFLX

BioFusion Labs

Beginner-friendly Investing

Learn the basics of stocks, ETFs, and passive income to start building your investment portfolio.

ASPC

AeroSpace Solutions

GNMD

Genome Dynamics

QNTX

QuantumTech

PHDC

Photon Dynamics Corp

ECTE

EcoTech

CYSG

CyberSec Global

FFDX

Future Foods

NMTL

NanoMaterials

GALX

Galactic Innovations

SGSY

SmartGrid Systems

RTBX

RoboTech Industries

IENC

Infinite Energy

UDG

Urban Development Group

AQRC

Aquatic Resources Corp

VRTX

Virtual Reality Ventures

INTA

Intelligent Automation

GHN

Global Health Networks

DSPH

DataSphere Analytics

SOLI

Solar Innovations

CATX

Clean Air Technologies

NTSO

NeuroTech Solutions

BFLX

BioFusion Labs

Beginner-friendly Investing

Learn the basics of stocks, ETFs, and passive income to start building your investment portfolio.

ASPC

AeroSpace Solutions

GNMD

Genome Dynamics

QNTX

QuantumTech

PHDC

Photon Dynamics Corp

ECTE

EcoTech

CYSG

CyberSec Global

FFDX

Future Foods

NMTL

NanoMaterials

GALX

Galactic Innovations

SGSY

SmartGrid Systems

RTBX

RoboTech Industries

IENC

Infinite Energy

UDG

Urban Development Group

AQRC

Aquatic Resources Corp

VRTX

Virtual Reality Ventures

INTA

Intelligent Automation

GHN

Global Health Networks

DSPH

DataSphere Analytics

SOLI

Solar Innovations

CATX

Clean Air Technologies

NTSO

NeuroTech Solutions

BFLX

BioFusion Labs

Beginner-friendly Investing

Learn the basics of stocks, ETFs, and passive income to start building your investment portfolio.

Achieve your financial goals

Achieve your financial goals

Achieve your financial goals

Build long-term financial discipline

Create sustainable financial habits that ensure continued growth and stability over the years.

Build long-term financial discipline

Create sustainable financial habits that ensure continued growth and stability over the years.

Build long-term financial discipline

Create sustainable financial habits that ensure continued growth and stability over the years.

Your statistics

Incomes

$4,800

Expenses

$3,600

Budget mastery toolkit

Get step-by-step guidance to design a personalized budget that aligns with your lifestyle and goals.

Your statistics

Incomes

$4,800

Expenses

$3,600

Budget mastery toolkit

Get step-by-step guidance to design a personalized budget that aligns with your lifestyle and goals.

Your statistics

Incomes

$4,800

Expenses

$3,600

Budget mastery toolkit

Get step-by-step guidance to design a personalized budget that aligns with your lifestyle and goals.

Сurriculum

What you'll learn in this course

Overview

5 modules

21 lessons

8,5 hrs of video content

6 tasks

20 files with presentations

Overview

5 modules

21 lessons

8,5 hrs of video content

6 tasks

20 files with presentations

Overview

5 modules

21 lessons

8,5 hrs of video content

6 tasks

20 files with presentations

The program is designed for self-paced learning. You can study whenever it suits you and always reach out to the mentor with any questions you may have.

1

Financial foundations

5 lessons

2

Budgeting strategies

4 lessons

3

Debt management

4 lessons

4

Savings & investments

5 lessons

5

Financial planning for the future

3 lessons

1

Financial foundations

5 lessons

2

Budgeting strategies

4 lessons

3

Debt management

4 lessons

4

Savings & investments

5 lessons

5

Financial planning for the future

3 lessons

1

Financial foundations

5 lessons

2

Budgeting strategies

4 lessons

3

Debt management

4 lessons

4

Savings & investments

5 lessons

5

Financial planning for the future

3 lessons

Process

Your journey review

1

Establish your goals and financial baseline

Identify your starting point by assessing your income, expenses, debts, and savings.

Set clear short-term and long-term financial goals, such as building an emergency fund, paying off debt, or starting to invest.

Use provided worksheets and templates to create your personalized financial roadmap, laying out achievable milestones.

2

Learn through self-paced, interactive modules

Access video tutorials, downloadable guides, and practical exercises covering essential topics: budgeting, debt management, savings strategies, and investing.

Use quizzes and assessments after each lesson to test your knowledge and reinforce what you’ve learned.

Track your progress using the course dashboard, receiving badges and certificates as you complete sections.

3

Practice with real-world scenarios and assignments

Apply what you’ve learned by working on assignments simulating real-world situations, such as creating investment portfolios, drafting a budget plan, or building debt repayment schedules.

Collaborate with other students in group projects to gain different perspectives on financial challenges.

Submit assignments for personalized mentor feedback to fine-tune your strategies and solutions.

Results

Transform your financial life

Master your budgeting

Develop financial discipline with budgeting methods tailored to your lifestyle. Track your spending, set realistic goals, and stick to a plan that ensures long-term stability.

Master your budgeting

Develop financial discipline with budgeting methods tailored to your lifestyle. Track your spending, set realistic goals, and stick to a plan that ensures long-term stability.

Master your budgeting

Develop financial discipline with budgeting methods tailored to your lifestyle. Track your spending, set realistic goals, and stick to a plan that ensures long-term stability.

Build savings habits

Learn to automate your savings and prioritize what matters most. Establish emergency funds and long-term savings accounts without sacrificing your lifestyle.

Build savings habits

Learn to automate your savings and prioritize what matters most. Establish emergency funds and long-term savings accounts without sacrificing your lifestyle.

Build savings habits

Learn to automate your savings and prioritize what matters most. Establish emergency funds and long-term savings accounts without sacrificing your lifestyle.

Manage debt efficiently

Break free from debt traps using tried-and-tested methods like snowball or avalanche strategies. Get actionable advice on maintaining a healthy credit score.

Manage debt efficiently

Break free from debt traps using tried-and-tested methods like snowball or avalanche strategies. Get actionable advice on maintaining a healthy credit score.

Manage debt efficiently

Break free from debt traps using tried-and-tested methods like snowball or avalanche strategies. Get actionable advice on maintaining a healthy credit score.

Grow investments

Gain a understanding of the stock market, mutual funds, and ETFs. Explore how compounding interest works and build a diversified portfolio.

Grow investments

Gain a understanding of the stock market, mutual funds, and ETFs. Explore how compounding interest works and build a diversified portfolio.

Grow investments

Gain a understanding of the stock market, mutual funds, and ETFs. Explore how compounding interest works and build a diversified portfolio.

About the author

Meet your mentor

Josh Davidson

Financial Coach with 10+ years of experience.

Josh Davidson

Financial Coach with 10+ years of experience.

Josh Davidson

Financial Coach with 10+ years of experience.

With over 10 years of coaching experience, Josh has worked with individuals, families, and entrepreneurs, helping them break the paycheck-to-paycheck cycle and establish financial stability. His teaching style focuses on practical, actionable advice designed to create habits that last a lifetime.

As a Certified Financial Planner (CFP), Josh brings insight and personalized strategies to his students. He’s a sought-after speaker and educator who conducts workshops on debt reduction, budgeting, and investment planning.

Helped over 500 people to become debt-free and financially empowered

Published two bestselling books on wealth-building strategies

Host of a personal finance podcast

His course is designed to empower learners, giving them the knowledge and confidence to make smart financial decisions and build long-term security.

💰 $1.5M+

Invested across client portfolios

💰 $1.5M+

Invested across client portfolios

💰 $1.5M+

Invested across client portfolios

📈 28% ROI

Average returns

📈 28% ROI

Average returns

📈 28% ROI

Average returns

PLAN

EARN

SAVE

INVEST

Our team

Invited experts

Ava Wright

Finance coach

Kari Rasmussen

Operations manager

Ethan Campbell

Data analyst

Jonathan Kelly

Accountant

Jordan Burgess

Finance team lead

Caitlyn King

Operations coordinator

Ava Bentley

Community manager

Ava Wright

Finance coach

Kari Rasmussen

Operations manager

Ethan Campbell

Data analyst

Jonathan Kelly

Accountant

Jordan Burgess

Finance team lead

Caitlyn King

Operations coordinator

Ava Bentley

Community manager

Ava Wright

Finance coach

Kari Rasmussen

Operations manager

Ethan Campbell

Data analyst

Jonathan Kelly

Accountant

Jordan Burgess

Finance team lead

Caitlyn King

Operations coordinator

Ava Bentley

Community manager

Pricing

Find the right plan for your needs

Monthly

Yearly

(Save 20%)

Basic

$25

per month, billed monthly

This entry-level plan covers essential resources to get started.

Basic includes:

Access to all lessons

Downloadable templates

Community access

Pro

Recommended

$100

per month, billed monthly

Elevate your financial skills with mentor guidance and live sessions.

everything in Basic, plus:

Mentor support via email

Monthly live Q&A sessions

Advanced tools and resources

Premium

$250

per month, billed monthly

Get full access to all features and one-on-one coaching.

everyting in Pro, plus:

1-on-1 coaching session

Customized investment plan

Webinars with guest experts

Monthly

Yearly

(Save 20%)

Basic

$25

per month, billed monthly

This entry-level plan covers essential resources to get started.

Basic includes:

Access to all lessons

Downloadable templates

Community access

Pro

Recommended

$100

per month, billed monthly

Elevate your financial skills with mentor guidance and live sessions.

everything in Basic, plus:

Mentor support via email

Monthly live Q&A sessions

Advanced tools and resources

Premium

$250

per month, billed monthly

Get full access to all features and one-on-one coaching.

everyting in Pro, plus:

1-on-1 coaching session

Customized investment plan

Webinars with guest experts

Monthly

Yearly

(Save 20%)

Basic

$25

per month, billed monthly

This entry-level plan covers essential resources to get started.

Basic includes:

Access to all lessons

Downloadable templates

Community access

Pro

Recommended

$100

per month, billed monthly

Elevate your financial skills with mentor guidance and live sessions.

everything in Basic, plus:

Mentor support via email

Monthly live Q&A sessions

Advanced tools and resources

Premium

$250

per month, billed monthly

Get full access to all features and one-on-one coaching.

everyting in Pro, plus:

1-on-1 coaching session

Customized investment plan

Webinars with guest experts

Testimonials

What our customers say

“This course made budgeting so simple! I’ve finally started saving each month without feeling overwhelmed.”

Sarah W.

@sarahw

“This course made budgeting so simple! I’ve finally started saving each month without feeling overwhelmed.”

Sarah W.

@sarahw

“This course made budgeting so simple! I’ve finally started saving each month without feeling overwhelmed.”

Sarah W.

@sarahw

“The templates were invaluable, and the community was super motivating. Having people to share wins and struggles with kept me going the whole time.”

Karen T.

@karentemplates

“The templates were invaluable, and the community was super motivating. Having people to share wins and struggles with kept me going the whole time.”

Karen T.

@karentemplates

“The templates were invaluable, and the community was super motivating. Having people to share wins and struggles with kept me going the whole time.”

Karen T.

@karentemplates

“I paid off $10,000 of debt fast using the snowball method. It was a game-changer!”

Mike D.

@mike_debtfree

“I paid off $10,000 of debt fast using the snowball method. It was a game-changer!”

Mike D.

@mike_debtfree

“I paid off $10,000 of debt fast using the snowball method. It was a game-changer!”

Mike D.

@mike_debtfree

“In just three months, I managed to build my emergency fund, and it gave me peace of mind.”

John F.

@john_saves

“In just three months, I managed to build my emergency fund, and it gave me peace of mind.”

John F.

@john_saves

“In just three months, I managed to build my emergency fund, and it gave me peace of mind.”

John F.

@john_saves

“Automating my savings through this course was a breakthrough. I no longer have to think about it—it just happens.”

Emily R.

@emily_saver

“Automating my savings through this course was a breakthrough. I no longer have to think about it—it just happens.”

Emily R.

@emily_saver

“Automating my savings through this course was a breakthrough. I no longer have to think about it—it just happens.”

Emily R.

@emily_saver

“The Q&A sessions were a highlight for me. I asked specific questions about my situation and got tailored advice that’s already made a difference.”

Alex B.

@alex_buildswealth

“The Q&A sessions were a highlight for me. I asked specific questions about my situation and got tailored advice that’s already made a difference.”

Alex B.

@alex_buildswealth

“The Q&A sessions were a highlight for me. I asked specific questions about my situation and got tailored advice that’s already made a difference.”

Alex B.

@alex_buildswealth

“Student loans were my biggest stress. This course gave me a step-by-step plan that actually works.”

Lauren P.

@lauren_prosper

“Student loans were my biggest stress. This course gave me a step-by-step plan that actually works.”

Lauren P.

@lauren_prosper

“Student loans were my biggest stress. This course gave me a step-by-step plan that actually works.”

Lauren P.

@lauren_prosper

“For the first time, I feel in control of my financial future. This course gave me the tools to start investing and saving properly.”

David K.

@dave_cashflow

“For the first time, I feel in control of my financial future. This course gave me the tools to start investing and saving properly.”

David K.

@dave_cashflow

“For the first time, I feel in control of my financial future. This course gave me the tools to start investing and saving properly.”

David K.

@dave_cashflow

“The investment section was fantastic. I finally understand the basics and have started planning for long-term growth.”

Jessica T.

@jess_trackit

“The investment section was fantastic. I finally understand the basics and have started planning for long-term growth.”

Jessica T.

@jess_trackit

“The investment section was fantastic. I finally understand the basics and have started planning for long-term growth.”

Jessica T.

@jess_trackit

Our students work in

Join our community of like-minded individuals focused on achieving financial independence.

Join our community of like-minded individuals focused on achieving financial independence.

Join our community of like-minded individuals focused on achieving financial independence.

Take control of your financial future today

Our personal finance course offers the tools and strategies you need to build a secure financial future.

24.8%

Total portfolio value

$ 42,560.00

Take control of your financial future today

Our personal finance course offers the tools and strategies you need to build a secure financial future.

24.8%

Total portfolio value

$ 42,560.00

Take control of your financial future today

Our personal finance course offers the tools and strategies you need to build a secure financial future.

24.8%

Total portfolio value

$ 42,560.00

FAQ

Discover answers to most pressing questions

Do I need prior financial knowledge to join this course?

How long does it take to complete the course?

Can I ask questions during the course?

Is there a refund policy?

Will I get updates if the course is expanded?

Need more information? Just send us a message!

Do I need prior financial knowledge to join this course?

How long does it take to complete the course?

Can I ask questions during the course?

Is there a refund policy?

Will I get updates if the course is expanded?

Need more information? Just send us a message!

FAQ

Discover answers to most pressing questions

Do I need prior financial knowledge to join this course?

How long does it take to complete the course?

Can I ask questions during the course?

Is there a refund policy?

Will I get updates if the course is expanded?

Need more information? Just send us a message!

Contact us

Have questions?

We’re here to help.

Contacts: